For many Australians, keeping a healthy bank balance feels like the ultimate safety net. But with inflation and tax quietly working against you, holding too much cash could be eating away at your wealth — to the tune of thousands of dollars every year.

Across the country, households are holding a record $1.46 trillion in savings, transaction accounts, term deposits, and offsets. But while that sounds reassuring, the reality is less comforting.

Savings accounts are taxed at your marginal rate — up to 47% for high earners — and inflation reduces what your money can buy. Even if you’re earning 4.5% interest, a 37% tax rate drops your return to about 2.8%. That’s already behind the Reserve Bank’s 3% inflation target, meaning you’re slowly going backwards.

Cash is a safety tool, not a growth strategy

Cash absolutely has its place. It’s ideal for:

- Covering unexpected expenses

- Short-term goals you’ll spend on within 12 months

- Providing peace of mind during uncertain times

But beyond an emergency fund of three to six months’ living costs, extra cash could be better used elsewhere.

Three ways to get your money working harder

1. Let your offset account do the heavy lifting

If you’ve got a mortgage, an offset account can be a simple, risk-free way to save interest. Every dollar in your offset reduces the loan amount you’re charged interest on, which is the same as earning a tax-free return at your mortgage rate.

For Example:

Let’s say you have a $750,000 mortgage at an interest rate of 5.8% p.a.

If you keep $40,000 in a high-interest savings account earning 4% per year, you’ll make $1,600 in interest. On a 32.5% marginal tax rate, that leaves just $1,080 after tax.

Now, instead, you put that $40,000 into your offset account.

Because the offset reduces the balance your mortgage interest is calculated on, you’re now paying interest on $710,000 instead of $750,000. At 5.8%, that’s a saving of $2,320 in the first year — and it’s completely tax-free.

With the offset account, you’re effectively getting a tax-free return equal to your mortgage rate — in this case, 5.8% — which beats the after-tax return from a savings account.

Do that every year, and over five years you’d save around $11,600, all without taking on any market risk or extra effort.

| Scenario | Savings Account | Offset Account |

| Amount deposited | $40,000 | $40,000 |

| Interest rate / Mortgage rate | 4.0% (savings) | 5.8% (mortgage) |

| Gross return / saving (p.a.) | $1,600 | $2,320 |

| Tax payable (32.5% rate) | -$520 | $0 |

| Net benefit after tax | $1,080 | $2,320 |

| Extra benefit with offset | – | +$1,240 |

2. Invest Consistently in Growth Assets.

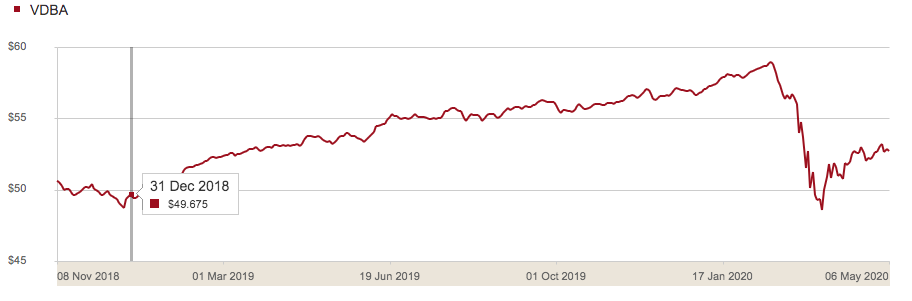

Once your cash buffer is sorted, you can put excess funds into shares, ETFs, or property. Regular investing takes advantage of compounding, turning even modest amounts into substantial long-term gains.

For Example:

Investing $1,500 per month for 20 years at an 8.5% annual return could grow to $940,498.

If the same amount went into a savings account earning 3.5%, it would only grow to $520,304.

That’s a difference of around $420,195 — money you could be missing out on by keeping excess funds in cash instead of growth assets.

3. Automate your progress

By scheduling automatic transfers into investment accounts, you remove decision fatigue and keep your wealth-building on track — regardless of market ups and downs.

See our blog on Smart Money Moves Every Woman Can Make to Build Real Wealth

The bottom line

Too much cash in the bank might feel safe, but over time it can quietly chip away at your financial future. By keeping the right amount for emergencies and short-term needs, then directing the rest towards debt reduction and growth assets, you’ll protect your stability while creating real long-term momentum.

At Unicorp Partners, we help clients design strategies that balance security with growth — so your money isn’t just sitting still, it’s moving you forward.