There’s been a lot of mainstream media attention of recent times suggesting the stock market has been decimated and that retirees have ‘lost everything’ thanks to the COVID-19 crisis.

But if we take a closer look at how markets have actually performed, is it really true that your retirement savings have been ‘decimated?’

The first thing we need to remember, is the last bull market that ended when COVID hit, was the longest in history. In fact, From the start of the bull market through to the start of March, the S&P 500 had delivered a cumulative return of 462.1%, according to FactSet. To cap that off, last year alone we had markets delivering us a gain of 31.5%.

To be fair, that’s a pretty reasonable winning run.

Since that point in time, the outbreak of COVID-19 has led to the onset of social distancing measures around the globe, and in many countries, the economies have gone into a virtual shutdown. While markets did fall initially, they have done a pretty good job of recovering.

In fact, looking at the S&P 500 in the US the index is trading at virtually the same level it was only 12 months ago. To suggest stocks have been decimated is perhaps a little bit premature.

Over the course of the year, the S&P 500 is in the red, but not by that much – around 10% at the time of writing.

But it’s also important to note that most investors don’t have a portfolio that is made up 100% with stocks. They are likely balanced in that they combine stocks, bonds and even other assets such as gold or REITs.

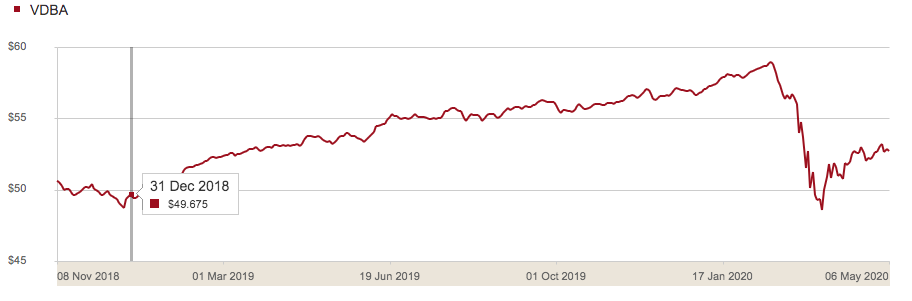

If we use a balanced portfolio as a benchmark to measure our performance we can look to the likes of the Vanguard Diversified Balanced Index ETF (VDBA). It is made up of a 50 per cent combination of Australian and International shares and 50 per cent fixed income such as bonds.

Vanguard Diversified Balanced Index ETF (VDBA)

So far in 2020, the Vanguard Diversified Balanced Index ETF is down only -4.8 per cent.

If we look back 12 months, we can see that this portfolio is actually up marginally.

If we compare the current price to the start of 2019, we can see this portfolio is up over 8 per cent.

None of these numbers would suggest your retirement savings have been decimated.

What Happen’s to Dividends?

Despite markets remaining solid, there are some things to consider going forward for retirees. One of those is the impact of dividends on your overall portfolio.

If your current portfolio is slanted towards income, then for the short-term there is a good chance those dividends will be taking a hair cut.

Almost all areas of the economy have been impacted by the economic shutdown and that will be filtered through to lower profits and lower dividend payouts for the next few periods.

But with prices remaining relatively robust, it’s clear that the market is still suggesting they can see an end in sight. When these restrictions start to ease, for many areas of the economy it will be business as usual, so hopefully, they can start generating profits and future dividends.

Just how fast the economy will bounce back is any one’s guess but we can look to history to see how the stock market has responded in the past.

History of Market Falls

If we look back from the start of 1950s to the current day, there have been 38 official stock market corrections in the S&P 500. What that means is falls of 10% or more from the most recent high.

Of these previous corrections in the S&P 500, 23 of them lasted 104 or fewer days. That’s only 3.5 months.

So far this current correction is 86 days long, or about 3 months and already, as we’ve seen, things have started to stabilise and improve.

It’s also important to note, that all of these previous corrections were completely erased by bull-markets in the ensuing months and years.

In the long-run, it mattered little, as to when you bought into those markets. You didn’t need to pick the bottom, or be ‘greedy when others were fearful’.

You just had to buy and then hold on. However, there are many things that need to be managed along the way to ensure that you can remain invested without selling your assets due to excess volatility causing panic.

As an Australian investor, this not only means rebalancing your asset allocation regularly to meet your risk tolerance but also having regard to currency movements between the Australian dollar and other currencies as these can have very long term trends that can have a meaningful negative or positive impact on your retirement portfolio.

The mainstream media are good at producing TV – just don’t let them have your believe your retirement has been decimated.

Skype With a Planner

Book your free 40 minute consultation on Skype. Email us some dates and times you are free so we can make a plan

+61 2 92999333

Meet a Planner

You would like to meet us one-on-one. We would love to meet with you! Please book an appointment on our online system

+61 2 92999333

Recent Comments